1 Section 7 of the Income Tax Act 1967 ITA 1967. 3 This Act shall have effect for the year of assessment 1968 and subsequent years of assessment.

Taxes In Malaysia Including Mm2h Entrepreneur Visas Penang And Labuan November 10th 2021 Advanced American Tax

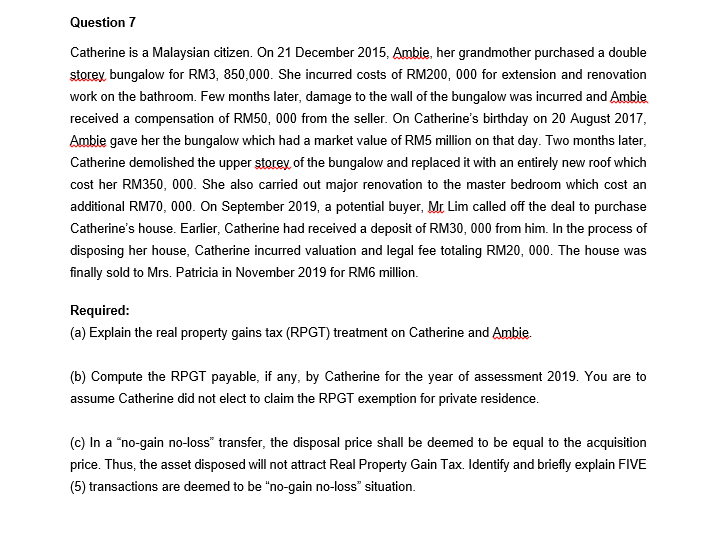

The Income Tax Act 1967 Act 53 the Real.

. Income attributable to a Labuan business activity of a Labuan entity including the branch or subsidiary of a Malaysian bank in Labuan is subject to tax under the Labuan Business Activity Tax Act 1990 LBATA. Chapter i PRELIMINARY Short title 1. In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

Short title and commencement 2. Malaysia for Malaysian citizen hisher spouse who have been approved by the special committee of Ministry of Human Resource PUA 672001 Wef 112001 Individual citizen 605 Employment with an operational headquarters company or a regional. Act 53 INCOME TAX ACT 1967 An Act for the imposition of income tax.

To assist in maintenance of a zoo museum art gallery or similar venture or engaged in something related to the. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1. While reading this article candidates are expected to refer where necessary to the relevant provisions of the Act and the Public Ruling 9 of 2015.

Meanwhile Anand Raj for the Malaysian Bar said a judgement from the apex court would benefit taxpayers and the IRB in general. Incentives Under Paragraph 1273b Of The Income Tax Act 1967 and Other Exempted Income. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

It feels really bad if you still have to pay income tax after retiring but good news - Malaysians dont pay any tax on that. Of Approval under Subsection 446 of the Income Tax Act 1967 ITA 1967 issued in January 2005. Company as a Malaysian resident provided it meets all the following conditions.

This exception will not apply if the Labuan entity has made an irrevocable election to be taxed under the Income Tax Act 1967 in respect of its Labuan business activity. A Labuan entity can make an irrevocable election to be taxed under the Income Tax Act 1967 in respect of its Labuan business activity. This article collates and discusses the provisions in the Income Tax Act 1967 the Act to assist candidates with understanding the more intricate issues relating to interest income and interest expense.

The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. The company is a resident in the immediate previous year of assessment. 1 This Act may be cited as the Income Tax Act 1967.

Tax Act 1967 the Labuan Business Activity Tax Act 1990 the Promotion of Investments Act 1986 the Finance Act 2012 and the Finance Act 2018. While explained in detail under Section 4d of the Income Tax Act 1967 the summary of it as according to LHDN is The letting of real property is treated as a non-business source and income received from it is charged to tax under paragraph 4d of the Income Tax Act 1967 if a person lets out the real property without providing maintenance. Non-chargeability to tax in respect of offshore business activity 3 C.

Of the Income Tax Act 1967 and whether the courts are entitled to consider. Itll also apply when the pension is paid due to retirement from. Updated on 24 December 2021.

Firstly pensions paid to people after reaching the age of retirement are exempt from tax under Schedule 6 Paragraph 30 of the Income Tax Act 1967. The directors of the company have to attend the. This Act may be cited as the Finance Act 2021.

Or b made or suffered the making of a contribution to a private retirement scheme approved by the Securities Commission. Section 30 of Income Tax Act 1967 Any recovery of a trade debt previously written-off as bad or specific provision for bad debt has been made should be shown as income in the Income Statement for the period in which it is received. The types of institution or organisation eligible to apply for.

This follows as at times or most of the times taxpayers could not pay the additional tax imposed and they could not challenge it. Hardships among Malaysian citizens. The chargeability of income is governed by Section 3 of the Income Tax Act 1967 ITA which states that income shall be charged for tax for each year of assessment YA upon the income of any person accruing in or derived from Malaysia.

1 Section 491D of the Income Tax Act ITA provides that income tax deduction not exceeding RM3000 can be claimed by an individual who has a paid premiums for a deferred annuity. No tax adjustment is required as the amount is already shown as income in the Income Statement. Charge of income tax 3 A.

12 These guidelines explain- i. Accordance with Malaysian tax law under the Income Tax Act 1967. Form BE refers to income assessed under Section 4 b 4 f of the Income Tax Act 1967 ITA 1967 and be completed by individual residents who have income other than business.

Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. The relief is restricted to the lower of Malaysian tax payable or foreign tax paid if there is a treaty or one-half of the foreign tax paid if there is no treaty.

Amendment of Acts 2. However Malaysian resident status is still applicable for purposes of the general application of the domestic law so that the individuals income remains assessable to Malaysian tax. ENACTED by the Parliament of Malaysia as follows.

Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1.

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

Individual Income Tax In Malaysia For Expats Gpa

Broadening The Tax Net Under Section 12 Crowe Malaysia Plt

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt

Tax Penalties A Necessary Evil Crowe Malaysia Plt

Ktps Consulting Investment Holding Company Ihc With Investment Properties Effective Ya2020 According To The Practice Note No 3 2020 Ihc Not Listed On Bursa Malaysia With Profit From Rent Income Subject To

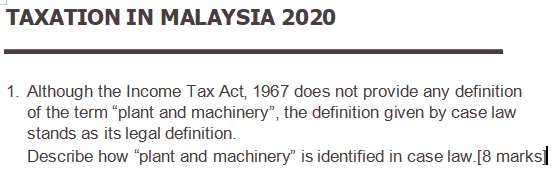

Solved Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Individual Income Tax In Malaysia For Expats Gpa

Best Payroll And Tax Services In Switzerland

View Full Version Here Http Www Imoney My Articles Bankruptcy Infographic Bankruptcy Reality Check

Asia Briefing Individual Income Tax In Malaysia For Expatriates

Solved Answer All Questions 1 A Give Three Examples Of Chegg Com

Taxation In Malaysia 2020 1 Although The Income Tax Chegg Com

Pdf Tax Simplicity And Small Business In Malaysia Past Developments And The Future Semantic Scholar

View Full Version Here Http Www Imoney My Articles Bankruptcy Infographic Bankruptcy Reality Check

Asia Briefing Individual Income Tax In Malaysia For Expatriates

A Quick Understanding On Taxability Of Foreign Sourced Income Crowe Malaysia Plt